PromptMarketer Team

Stop Bleeding Leads: FinTech Marketing Automation that Builds Trust and Crushes Compliance

The FinTech landscape is a minefield. You're not just battling competitors for market share; you're navigating a complex web of regulations, striving to build unwavering trust, and constantly searching for high-quality leads. It's a delicate balance, and one wrong step can lead to hefty fines and irreparable reputational damage. But what if you could automate your marketing efforts, ensuring compliance and fostering trust while generating a consistent stream of qualified leads?

[Watch Video Hook: A red alert siren blares over a graphic depicting a news headline: "FinTech Firm Fined $10 Million for Compliance Breach." (HOOK) The camera rapidly zooms in on the shocked face of a fictional CFO, sweat dripping down his brow. (SCENE - Close-up, high-speed camera, dramatic shadows) Suddenly, the scene cuts to a smooth, clean interface of Prompt Marketer, showcasing its AI-powered compliance checker rapidly flagging and fixing potentially problematic content. (TWIST) The visual style should be clean, modern, and tech-forward, reminiscent of Apple product videos.]

The FinTech Marketing Tightrope Walk: Leads, Compliance, and Trust

Generating high-quality leads in the competitive FinTech space is tough enough. Layer on the stringent regulatory environment, and it becomes a high-stakes balancing act. Here's the reality many FinTech marketing managers face:

- Difficulty generating high-quality leads: Standing out from the crowd requires innovative strategies.

- Risk of non-compliance: Hefty fines and reputational damage can cripple your business.

- Time-consuming manual review: Ensuring every piece of content meets compliance standards is incredibly time-intensive.

- Low engagement rates due to lack of personalization: Generic messaging doesn't resonate with discerning FinTech prospects.

This all adds up to wasted resources, missed opportunities, and constant anxiety. But there's a better way.

Prompt Marketer: Your Trust-Building Marketing Automation Solution for FinTech

Prompt Marketer bridges the gap between powerful AI and effective content marketing for the FinTech industry. It's designed to create dynamic workflows that automate your entire organic marketing process, ensuring compliance, personalization, and, most importantly, trust.

For FinTechs, we define "Vibe Marketing" as "Trust-Building Marketing" – ensuring all content resonates with security, privacy, and regulatory concerns. Prompt Marketer empowers you to create content that not only attracts leads but also establishes your brand as a reliable and trustworthy partner.

Automate Your Way to FinTech Marketing Success: Specific Examples

Prompt Marketer isn't just about automating tasks; it's about strategically automating the right tasks to maximize impact. Here are a few specific examples of how Prompt Marketer can transform your FinTech marketing:

Content Repurposing: Amplify Your Message, Effortlessly

Stop letting valuable content gather dust. Automate the repurposing of lengthy white papers on fraud detection trends into engaging LinkedIn posts, Twitter threads, and short explainer videos.

- Example: Take a 5,000-word white paper on "The Evolving Landscape of Payment Fraud" and automatically generate 5 LinkedIn posts, 10 tweets, and a 60-second animated video summarizing the key findings.

This not only saves time but also ensures your message reaches a wider audience across multiple platforms.

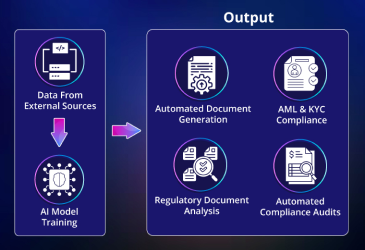

Compliance Checks: Never Miss a Regulatory Beat

Integrating Prompt Marketer with regulatory databases allows you to automatically flag potentially non-compliant content before it's published. This dramatically reduces the risk of fines and reputational damage.

- Example: Before publishing a blog post on KYC/AML compliance, Prompt Marketer automatically checks for outdated information and potential misinterpretations of regulations.

Personalized Email Outreach: Connect on a Deeper Level

Generic emails are a thing of the past. Automate personalized email outreach based on trigger events like industry news or regulatory changes.

- Example: When a new anti-money laundering regulation is announced, automatically send personalized emails to prospects highlighting how Prompt Marketer helps companies stay compliant.

This level of personalization demonstrates that you understand their needs and are proactive in addressing their concerns.

Dynamic Landing Pages: Speak Directly to Your Audience

Personalize landing pages based on the prospect's role (e.g., CFO, Compliance Officer, CTO) to deliver the most relevant information. This increases engagement and conversion rates.

- Example: Show a CFO testimonials about ROI, show a Compliance Officer how Prompt Marketer reduces risk, show a CTO integrations with internal systems.

Case Study: SecureAI - AI-Powered Fraud Detection Success

SecureAI, a leading FinTech company offering AI-powered fraud detection, leverages Prompt Marketer to automate content creation showcasing real-time fraud prevention successes.

By using Prompt Marketer, SecureAI personalizes landing pages based on the prospect's role, delivering targeted messaging that resonates with their specific needs. For example:

- CFOs are presented with data on how SecureAI reduces fraud-related losses and improves the bottom line.

- Compliance Officers see detailed information on how SecureAI helps them meet regulatory requirements and avoid penalties.

- CTOs are shown how SecureAI integrates seamlessly with their existing systems and enhances their overall security infrastructure.

This personalized approach has significantly increased SecureAI's lead generation and conversion rates.

CRO Strategies for Trust: Building Credibility Every Step of the Way

Beyond automation, building trust requires a conscious effort to implement Conversion Rate Optimization (CRO) strategies that reinforce your commitment to security and transparency:

- Implement trust signals: Display security certifications (e.g., ISO 27001), SOC 2 compliance badge, and data privacy statements prominently on your website.

- Use clear and concise value propositions: Avoid FinTech jargon that can confuse or alienate potential customers. For example, instead of "Leverage our AI-powered fraud detection solution," use "Stop fraud before it happens with AI that protects your customers and your bottom line."

- Provide transparent pricing information: Offer clear pricing plans and avoid hidden fees. Transparency builds trust and demonstrates that you're confident in the value you provide.

Ready to Transform Your FinTech Marketing?

Stop letting compliance concerns stifle your marketing efforts. Prompt Marketer empowers you to automate your marketing, build trust, and stay compliant, all while generating high-quality leads.

Visit promptmarketer.com and schedule a demo today to see how Prompt Marketer can help your FinTech company thrive. Don't bleed leads - automate your success!

Keywords: FinTech marketing automation, AI for FinTech marketing, SaaS marketing automation FinTech, compliance marketing automation, trust-based marketing FinTech, lead generation FinTech, n8n FinTech

Related Articles

Reclaim Your Time: AI-Powered LinkedIn and Twitt...

Reclaim Your Time: AI-Powered LinkedIn and Twitter Automation for Solopreneurs Wearing all the hats? Feeling overwhelmed by social media marketing?...

Automate Hyperlocal Social Media for Local Busin...

Automate Hyperlocal Social Media for Local Businesses with AI Are you a social media marketing agency struggling to scale social media agency wit...

Unlock Explosive E-commerce Growth: Automate On-...

Unlock Explosive E-commerce Growth: Automate On-Page SEO with AI Are you an SEO specialist or content marketer struggling to scale organic traffic...