PromptMarketer Team

Supercharge FinTech Marketing Automation with Prompt Marketer: From Money20/20 Leads to MQLs

Are you a B2B SaaS company in the FinTech space looking to revolutionize your marketing strategy? Following a successful event like Money20/20, capturing and nurturing those valuable leads is paramount. FinTech marketing automation is no longer a luxury, but a necessity. This blog post will guide you through leveraging Prompt Marketer, a comprehensive marketing automation solution, to transform post-webinar leads into Marketing Qualified Leads (MQLs), focusing on personalization, AI-powered qualification, and workflow automation. We’ll illustrate how to maximize the impact of your Money20/20 investment and demonstrate a practical workflow to turn attendees into paying customers.

1. Personalized Content Creation: Murf.ai Integration for Authentic Engagement

In the competitive FinTech landscape, generic follow-ups simply won't cut it. Prompt Marketer understands the need for personalization, which is why it seamlessly integrates with Murf.ai, a powerful AI voice platform. This integration allows you to create highly personalized content that resonates with your leads on a deeper level.

Personalized Video Messages that Convert

Imagine this: A prospect, let's call him David, attended your Money20/20 webinar on "The Future of AI in FinTech Compliance." He's now a lead in your CRM. With Prompt Marketer and Murf.ai, you can craft a personalized video message from Anya Sharma, the Head of Innovation at ComplianceTech (and fictional webinar speaker).

The video, featuring Anya’s AI-generated voice, addresses David directly: "Thanks for your insightful question about AI bias in fraud detection, David! I know that Compliance is important to you. We understand. Download our comprehensive Whitepaper, "The Compliance Officer's Guide to AI Automation" to learn more about that important subject."

This level of personalization demonstrates genuine engagement and instantly captures David's attention.

Tailored Audio Content: Engaging Leads on the Go

To further personalize the experience, Prompt Marketer can generate an audio version of the whitepaper's introduction using Murf.ai. This audio snippet can be tailored to the listener's role (pulled directly from CRM data). For example, if David is a Compliance Manager, the audio introduction could emphasize the efficiency gains and risk reduction aspects of AI automation.

Bulk Personalized Videos: Prompt Marketer Workflow

Prompt Marketer simplifies the creation of these personalized videos in bulk through its robust Murf.ai API integration. Here's how the workflow looks:

- Data Source: Connect Prompt Marketer to your CRM (e.g., Salesforce).

- Segmentation: Segment leads based on webinar attendance and questions asked.

- Murf.ai Integration: Use Prompt Marketer to send lead data to Murf.ai's API.

- Video Generation: Murf.ai generates personalized videos using pre-defined templates and variables (attendee name, question topic).

- Delivery: Prompt Marketer automatically sends the personalized videos via email.

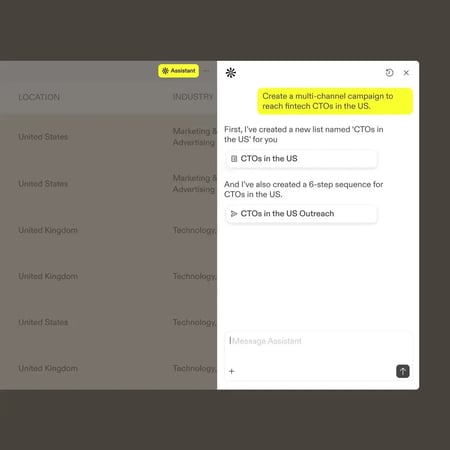

2. AI-Powered Lead Qualification: Talia Chatbot for Smarter MQL Generation

Driving traffic to your whitepaper download page is only half the battle. Qualifying those leads is crucial. Prompt Marketer utilizes the Talia chatbot platform to intelligently engage visitors and identify MQLs. The Talia Chatbot makes lead scoring chatbot FinTech automation example.

Engaging Visitors with Qualifying Questions

The Talia chatbot, embedded on the whitepaper download page, proactively engages visitors. It asks qualifying questions designed to gauge their interest and suitability for your solution:

- "What are your biggest compliance challenges?"

- "What AI solutions are you currently evaluating?"

- "What's your budget allocation for compliance technology?"

Dynamic Chatbot Scripts: Tailoring the Conversation

Prompt Marketer allows you to dynamically adjust chatbot questions based on the visitor's industry sub-vertical. For instance, if David works in Banking, Talia might ask questions specific to banking compliance. If he's in Insurance, the questions would shift to insurance-related challenges. This ensures relevance and increases engagement.

Automated Lead Scoring and CRM Integration: Connecting PM with Salesforce

Prompt Marketer automatically scores leads based on their Talia chatbot responses. This score reflects their likelihood of becoming a customer. The system integrates seamlessly with CRM systems like Salesforce, updating lead status in real-time.

Demo Request Routing: Converting Qualified Leads

Users who score above a pre-defined threshold (a "Qualified Lead Rate" of 75% or higher) are automatically routed to a sales demo request form, which is also easily set up within Prompt Marketer. This ensures that your sales team focuses only on the most promising prospects.

3. B2B SaaS FinTech Vibe Marketing Persona Shift with Sprout Social

Prompt Marketer enables you to refine your buyer personas within the FinTech space using Sprout Social. This is critical because understanding your audience's "vibe" – their current interests and concerns – can drastically improve your marketing effectiveness.

Analyzing Influencer Vibes: Understanding the FinTech Conversation

Begin by analyzing the social media "vibe" of leading FinTech influencers like Bill Gates and Elon Musk. Sprout Social can help you identify the topics they're discussing, the sentiment surrounding those topics, and the language they're using. This provides valuable insights into current trends and concerns within the industry.

Shifting Your Persona: Adapting to Market Realities

Previously, your primary persona might have been a "Tech-savvy Compliance Manager focused on efficiency." However, after analyzing the influencer vibe, you might discover that the market has shifted. The new persona is now a "Risk-averse but Innovation-Curious Compliance Leader prioritizing security and ROI of AI solutions."

This shift impacts your entire marketing strategy. Your campaign focus moves from simply highlighting efficiency gains to emphasizing security features and demonstrating a clear return on investment. Your messaging tone becomes more cautious and reassuring, and your content types might shift from quick tips to in-depth case studies. Prompt marketer is ready to work for the automated persona shift marketing SaaS FinTech.

Vibe Marketing in Practice

Vibe marketing focuses on creating an emotion around a brand rather than explicitly promoting specific products or features, much like vibe coding, using conversational "vibes" rather than technical syntax.

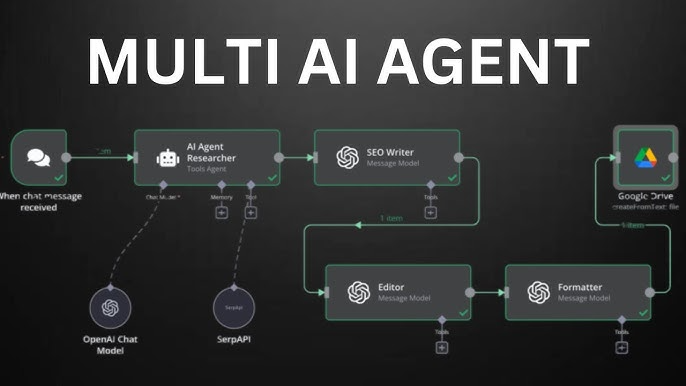

4. Workflow Automation: n8n Integration for Seamless Lead Nurturing

Prompt Marketer utilizes an n8n integration to automate the entire lead nurturing workflow, from webinar attendance to sales demo request. The n8n Integration provides a FinTech webinar automation workflow.

Workflow Setup: Step-by-Step Automation

Here's a breakdown of the automated workflow:

- Trigger: User attends Money20/20 webinar.

- Action 1: CRM updates lead status to "Webinar Attendee."

- Action 2: Prompt Marketer generates personalized video message with Murf.ai and sends it via email.

- Action 3: User visits whitepaper download page.

- Action 4: Talia chatbot engages user and qualifies lead.

- Action 5: Qualified lead is routed to a sales demo request form and notified on Slack.

- Action 6: Sales rep receives Slack notification with lead information.

5. Micro-Conversion Tracking & Optimization: Data-Driven Improvements

Tracking micro-conversions is essential for optimizing your lead nurturing process. Prompt Marketer provides a comprehensive analytics dashboard to monitor key metrics.

Key Metrics: Qualified Lead Rate and Demo Request Conversion Rate

Focus on the "Qualified Lead Rate" (percentage of webinar attendees becoming qualified leads via Talia chatbot) and the "Demo Request Conversion Rate" (percentage of qualified leads requesting a demo). These metrics provide valuable insights into the effectiveness of your lead nurturing efforts.

A/B Testing for Optimization: Improving Conversion Rates

Prompt Marketer facilitates A/B testing of chatbot scripts and video content. This allows you to identify the most effective messaging and optimize your micro-conversion rates.

Conclusion: Unlock FinTech Marketing Automation with Prompt Marketer

Prompt Marketer offers a powerful, integrated solution for B2B SaaS FinTech companies looking to maximize their marketing ROI. By leveraging personalized content creation, AI-powered lead qualification, vibe marketing persona shift, and workflow automation, you can transform post-webinar leads into qualified opportunities and drive significant revenue growth. It can even help you automate webinar follow up B2B FinTech SaaS.

Ready to take your FinTech marketing to the next level? Start your free trial with Prompt Marketer today and see the difference! Don't forget to check out our pricing plans.

Related Articles

AI-Powered Vibe Marketing: From TikTok Threads t...

AI-Powered Vibe Marketing: From TikTok Threads to Cybersecurity Thought Leadership In today's crowded digital landscape, standing out requires more...

Vibe Marketing for Agencies: Hyper-Personalized...

Vibe Marketing for Agencies: Hyper-Personalized Customer Journeys with AI Vibe marketing is transforming how marketing agencies connect with potent...

AI-Powered Marketing Automation: Improve Your Pr...

AI-Powered Marketing Automation: Improve Your Product and Customer Experience with Prompt Marketer In today's fast-paced digital landscape, busines...